As a part of financial litrecy our main thought process is to clarify the Relationship of money with human life. Money is the medium for using relationship, health, materialistic things and all…. So, we are providing solutions about how to handdle money for all this. Our thought process is everyone should get his hard-earned money at the right Time he wants. We run this bussiness thinking on “driven by passion; commiteed to excellence”

Our mission is to empower families to get the right amount of money available at the right point of time and achieve their financial goals by understanding their money relationship.

Our vision is to increase financial literacy in India and become a retirement expert of 10 thousand families by starting their passive income.

As a part of financial litrecy we must think on health first. So health insurance is Wealth insurance.

Life is 2 nd most part in financial literacy. There is a liablities in life so we need life Insurance.

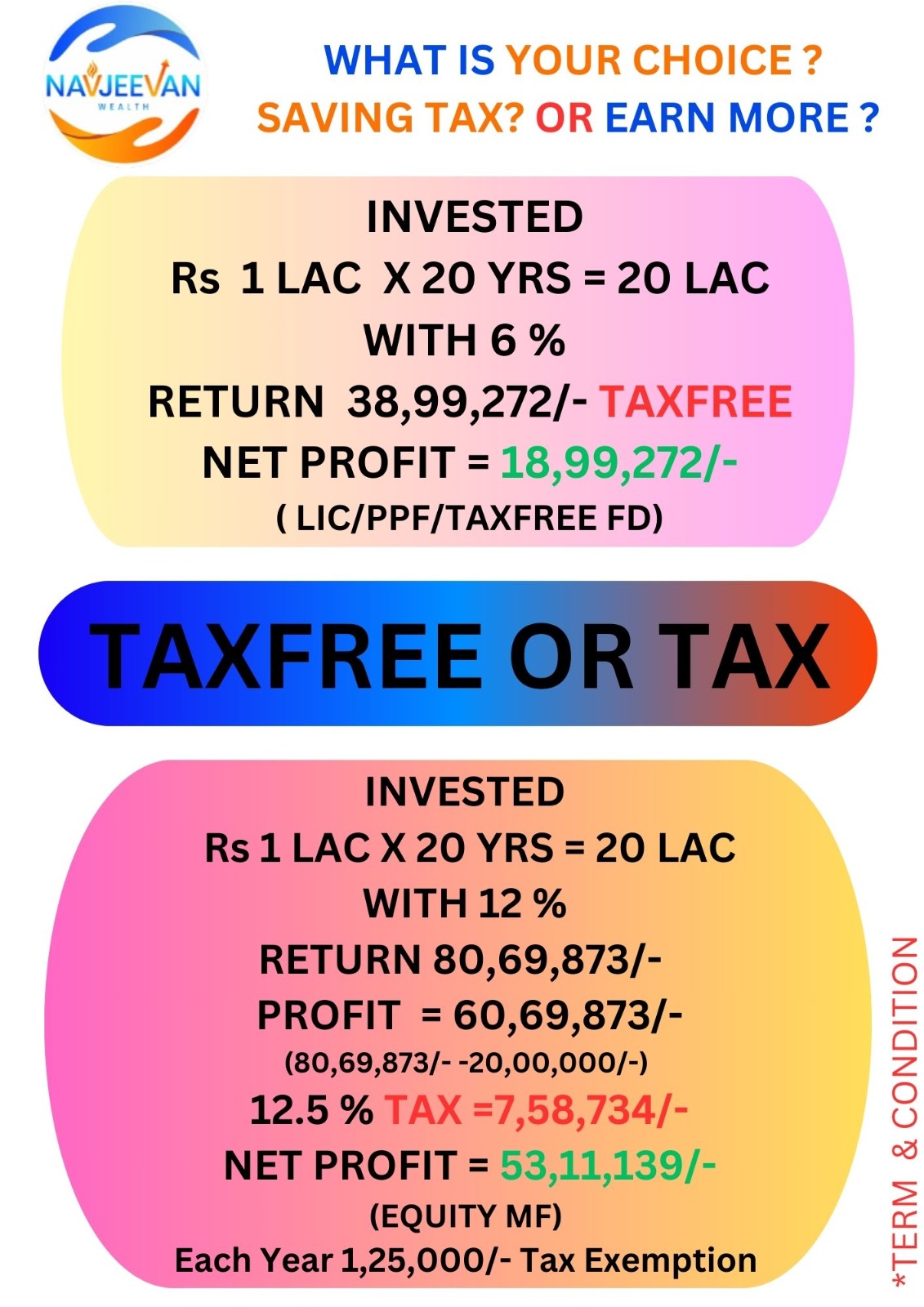

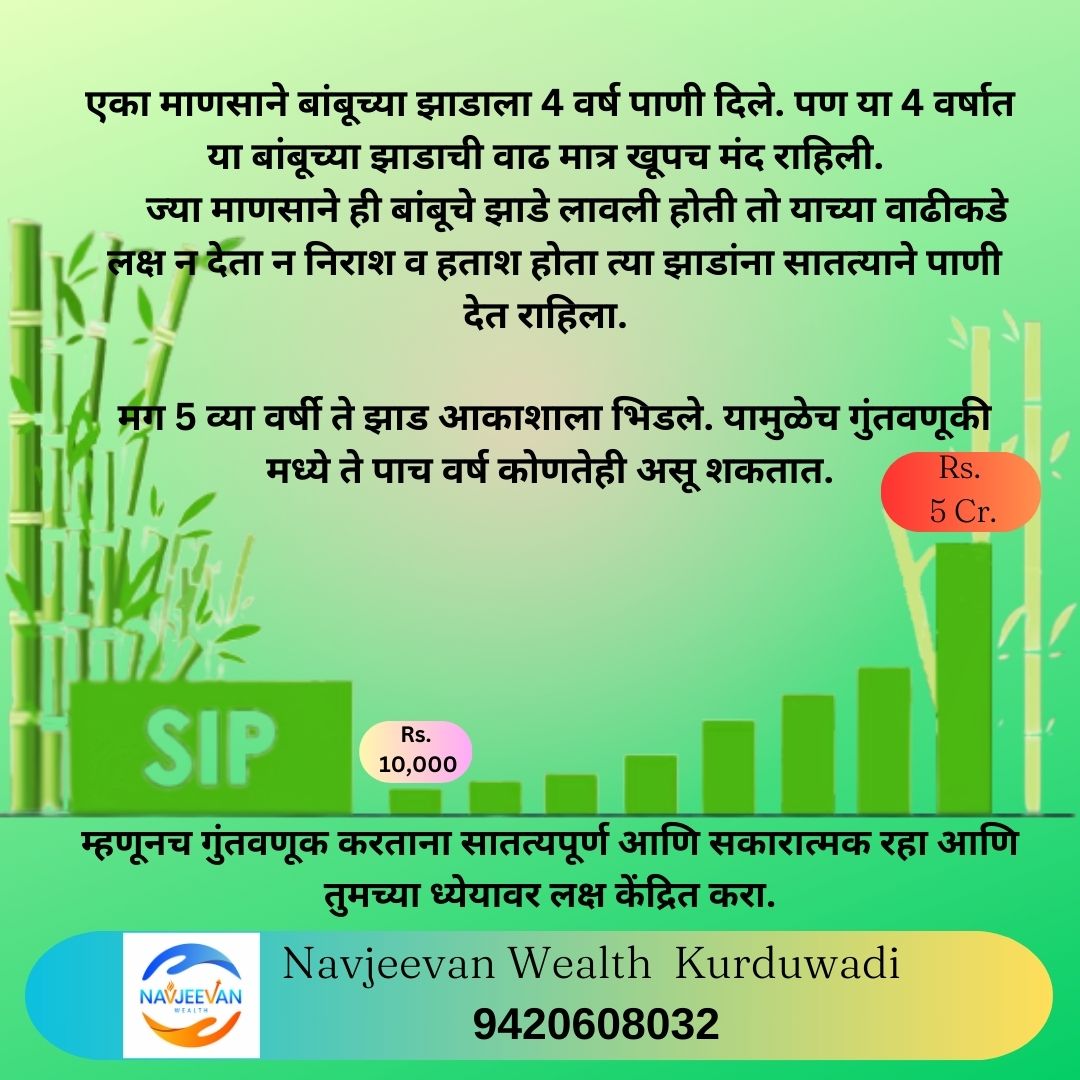

For retirement dont expect children as a retirement plan, invest atleast 10 % of Monthly income for retirement.

Invest in knowladge gives best intrest. So we must invest for child education for his/her bright future.

Financial goals are the priorities and targets you set for how you want to spend and save your money. They aren't one size fits all, because everyone has different priorities. However, if you don't set your financial goals, you'll probably be left wondering where all your money went. Importance of Setting Goals.

We've been helping businesses to do their best since 2003. If you need any solution we are available for you. Feel free to connect with us any time.

"Navjeevan Wealth is helping in identifying financial goals and preparing investment plans according to them. Their personalized advice and always ready-to-help approach is very helpful for me to intake financial decisions. "

"Nice to meet Dr.Harshad Shah owner of Navjeevan family, I am really thankful to you for guiding me in my life and you are giving new life to us all as per your name Navjeevan."

"My experience with Navjeevan Wealth is very good. It was very helpful for everyone and here we learn.. how to invest our money? And how to set our financial goals ?"

"Dr. Harshad, in true sense doctor for Health as well as Wealth! One can ask any query regarding Financial goals and get satisfied with proper solution…"

"Todays meeting with Dr Megha and Dr Harshad shaha very good counselling to my son for his career, life changing Guidance to me .y both r great personality .I feel very very happy. Thanks Dr Megha , and Dr Harshad shaha."